If traditional financial concepts are the sturdy foundations of the banking world, cross-border payments are the high-speed rails that connect global economies, a network of digital arteries pulsing with the lifeblood of international commerce.

Our dive into cross-border payment statistics and trends charts a course through the ever-evolving international finance sector, navigating the complexities of real-time transactions, digital wallets, and emerging technologies reshaping how businesses and individuals engage in global trade.

Explore the $190.2B cross-border payments market, set to reach $392.01B by 2033, at a 7.5% CAGR. Mobile wallet and other real-time payment solutions reshaping global trade. Meta Description

Data Sources and Methodology

This article combines open-access resources and proprietary data to present accurate, up-to-date statistics and trends on cross-border payment. Our methodology involves:

- Aggregating data from government databases, industry reports, and academic publications

- Incorporating exclusive insights from leading industry providers

- Regular updates to reflect the latest information

Key data providers include:

While we strive for accuracy, trends in cross-border payment can shift rapidly.

These statistics reflect current patterns and should not be considered permanent facts.

Key Takeaways

- The cross-border payments market is expected to reach USD 243.1 billion by 2026 and grow to USD 392 billion by 2033, reflecting a 7.5% CAGR.

- B2B cross-border transactions will surpass USD 42.7 trillion by 2026, with 80% processed via wire transfers.

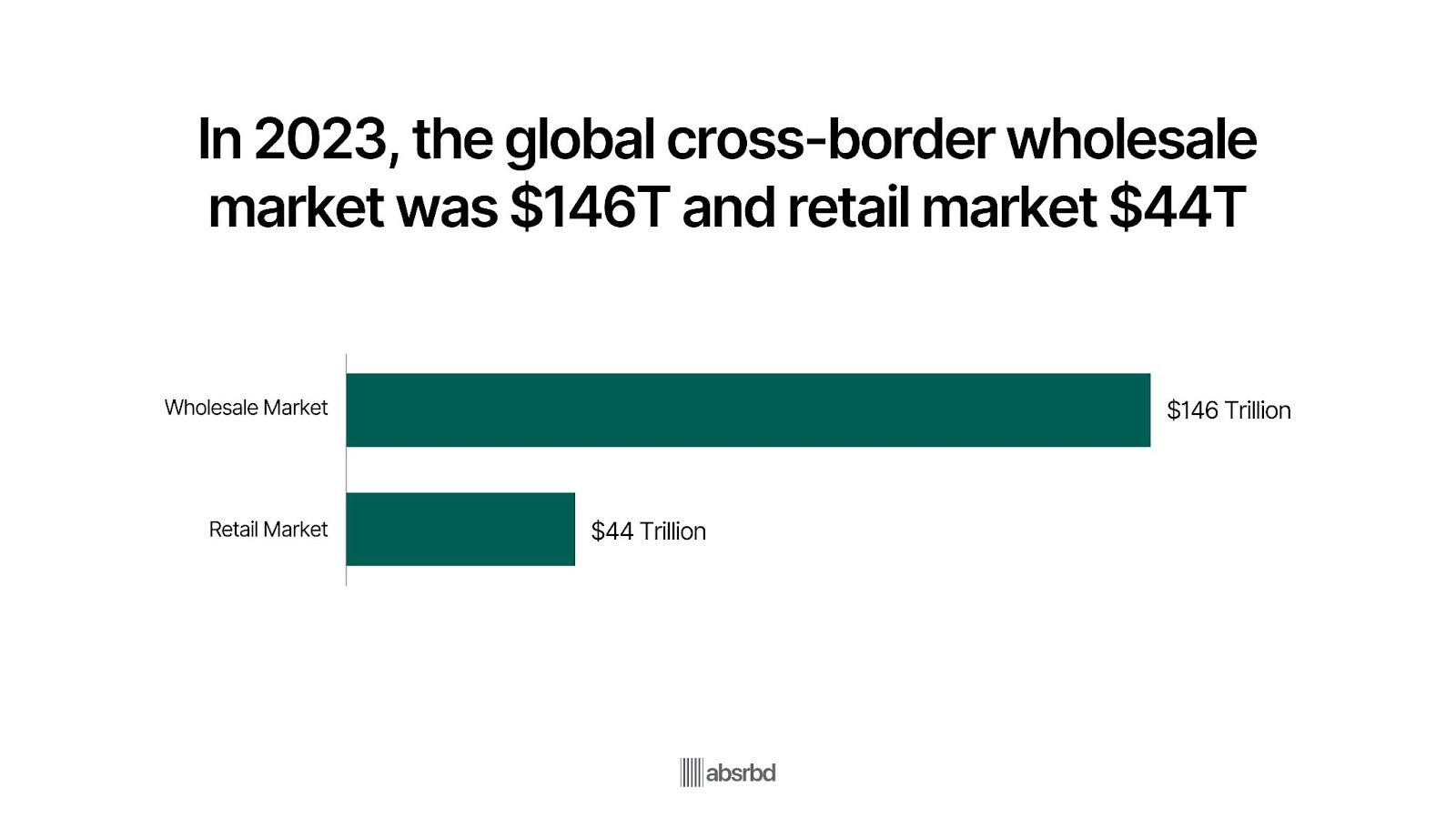

- In 2023, the wholesale cross-border market totaled USD 146 trillion, while the retail market reached USD 44 trillion.

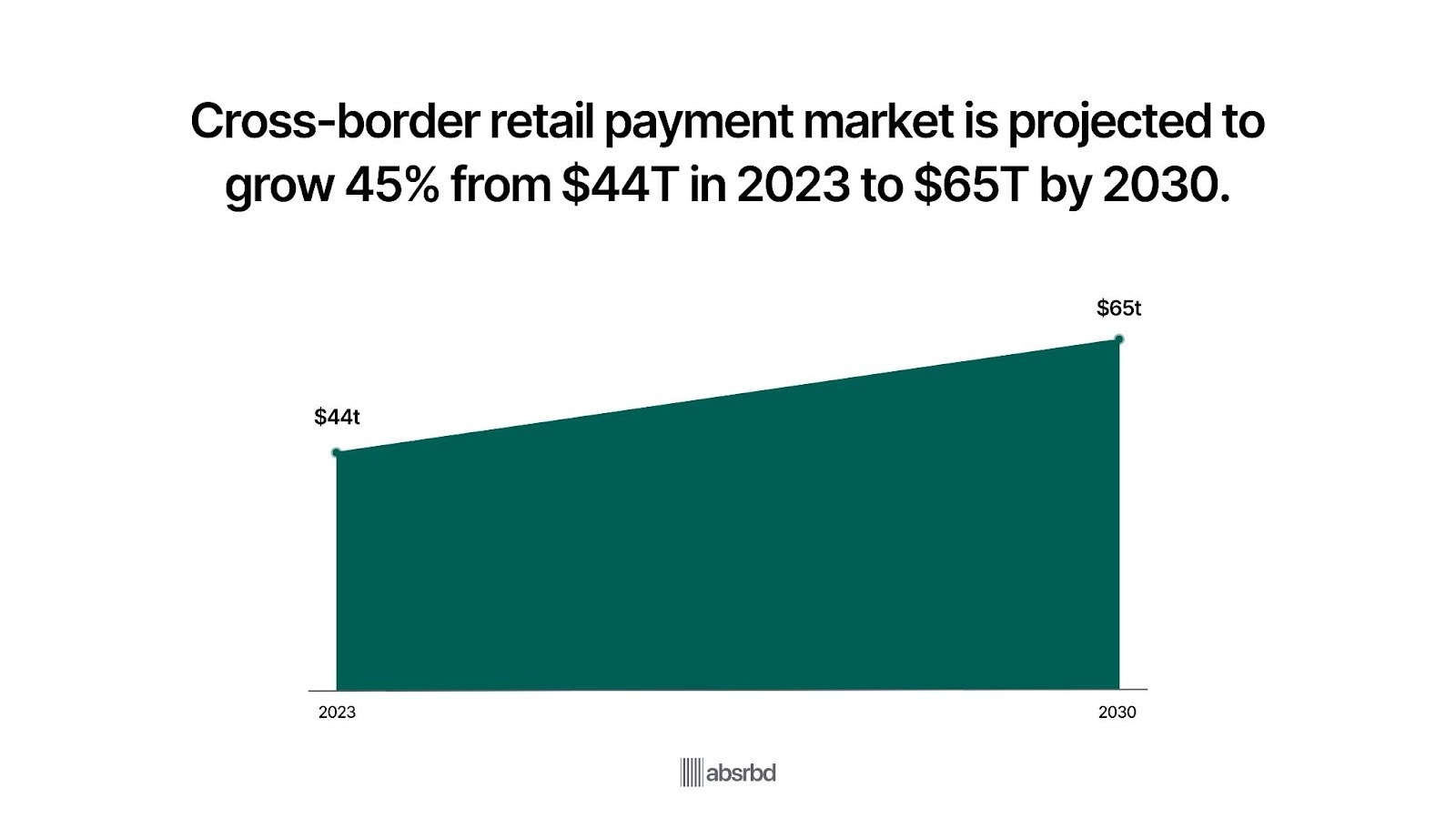

- Retail non-wholesale payment flows are projected to rise 45%, from USD 44 trillion in 2023 to USD 65 trillion by 2030.

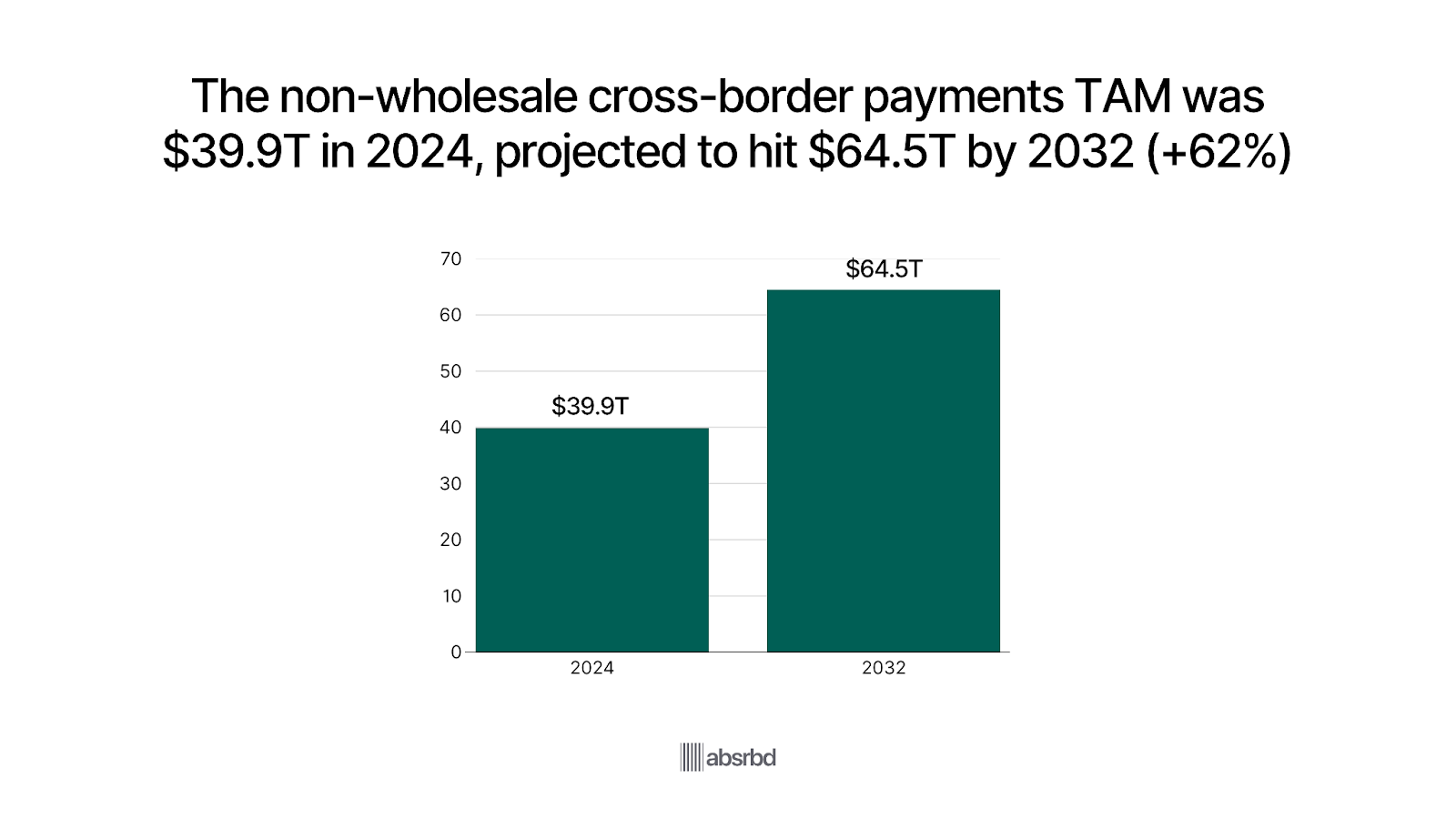

- The non-wholesale cross-border payments TAM will expand 62%, from USD 39.9 trillion in 2024 to USD 64.5 trillion by 2032.

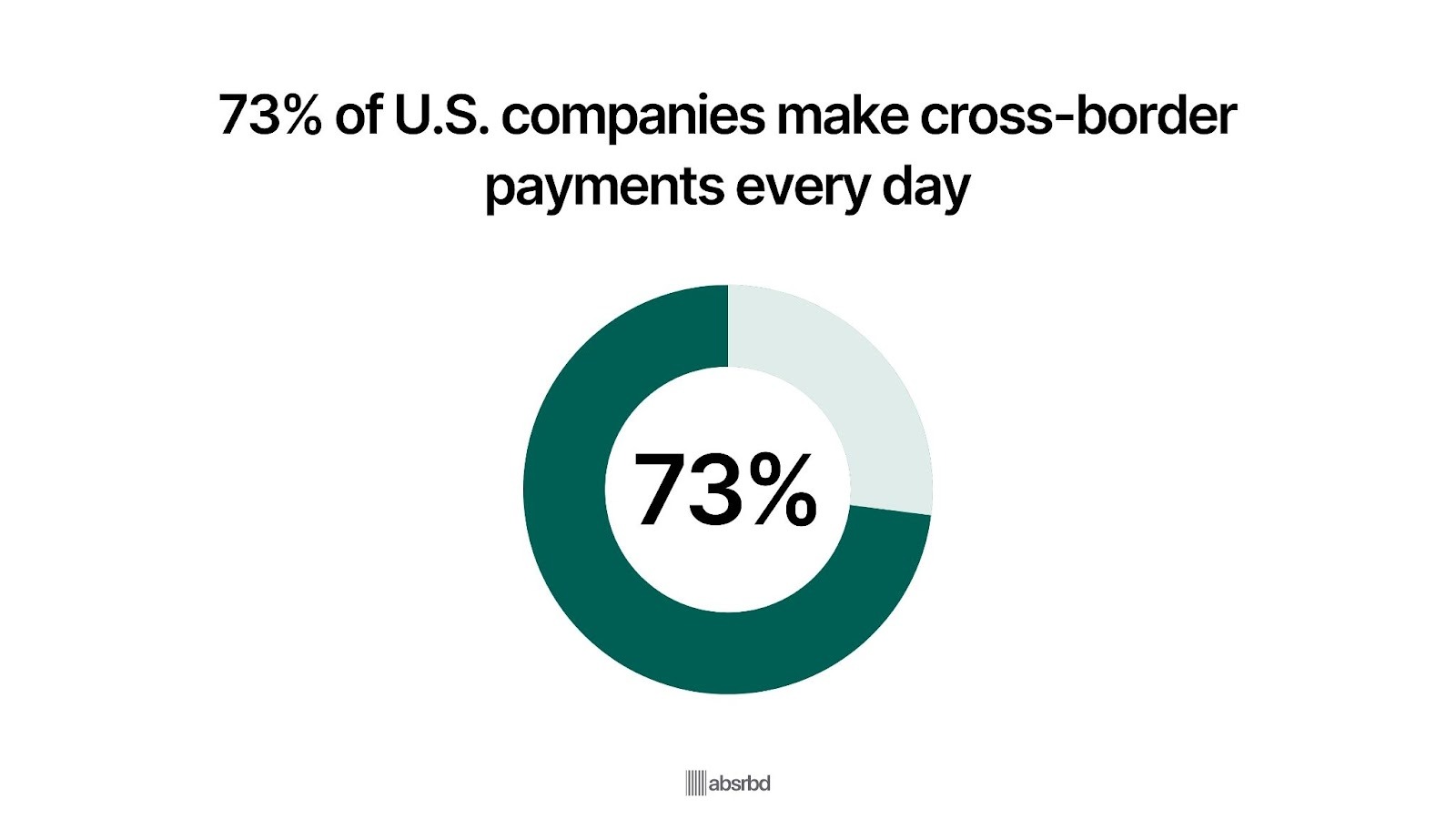

- Around 73% of U.S. companies conduct cross-border payments daily, highlighting widespread international business activity.

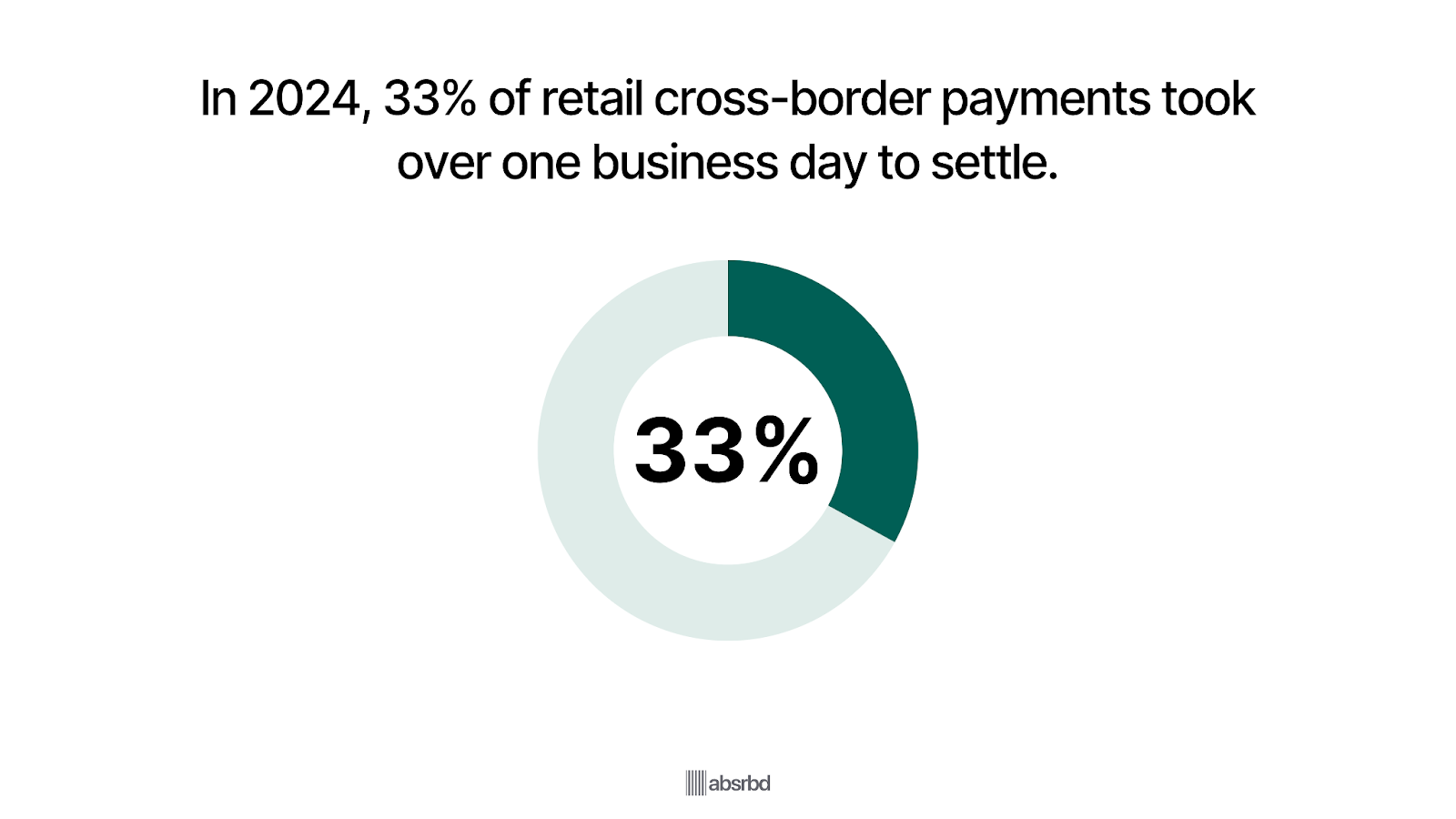

- In 2024, 33% of retail cross-border payments took over one business day to settle, showing ongoing efficiency gaps.

Overview of Cross-Border Payment

Cross-border payments emerged in the late 20th century, driven by the growth of international trade and globalization.

It refers to the transfer of funds between individuals, businesses or financial institutions located in different countries.

Since its inception, cross-border payments have evolved significantly, with the advent of digital technologies and the rise of fintech companies marking key milestones.

Major players include traditional banks, payment processors like Visa and Mastercard, and fintech companies such as TransferWise and Ripple.

Factors such as the increasing adoption of mobile payments, the rise of e-commerce, and the need for faster and more efficient transactions continue to shape the trajectory of the industry.

With cross-border payments estimated to increase from almost $150 trillion in 2017 to over $300 trillion by 2030, this sector plays a crucial role in the global economy, facilitating international trade and commerce. This makes it a key area of focus for businesses, financial institutions, and policymakers, who are working to address challenges such as high costs, slow transaction times, and limited transparency.

Key Statistics

- The cross-border payments market is estimated to be USD 243.1 billion in 2026 Research Nester

- The market is projected to grow to $392.01 billion in 2033 at a CAGR of 7.5%. The Brainy Insight

- B2B cross-border transaction value is projected to exceed USD 42.7 trillion by 2026, with about 80% of that value via wire transfers. Bizcommunity

- More than one-third 33% of retail cross-border payments took more than one business day to settle in 2024. European Central Bank

- The wholesale market, which includes high-value transactions, accounted for around $146 trillion in 2023, while the retail market totaled approximately $44 trillion in 2023. Convera

- Non-wholesale retail market payment flows are forecast to expand by 45%, from $44 trillion in 2023 to $65 trillion by 2030. Convera

- The non-wholesale cross-border payments segment had a TAM of USD 39.9 trillion in 2024, expected to grow to USD 64.5 trillion by 2032 62% increase. FXC Intelligence

- Approximately 73% of U.S. companies engage in cross-border payments daily. Citcon

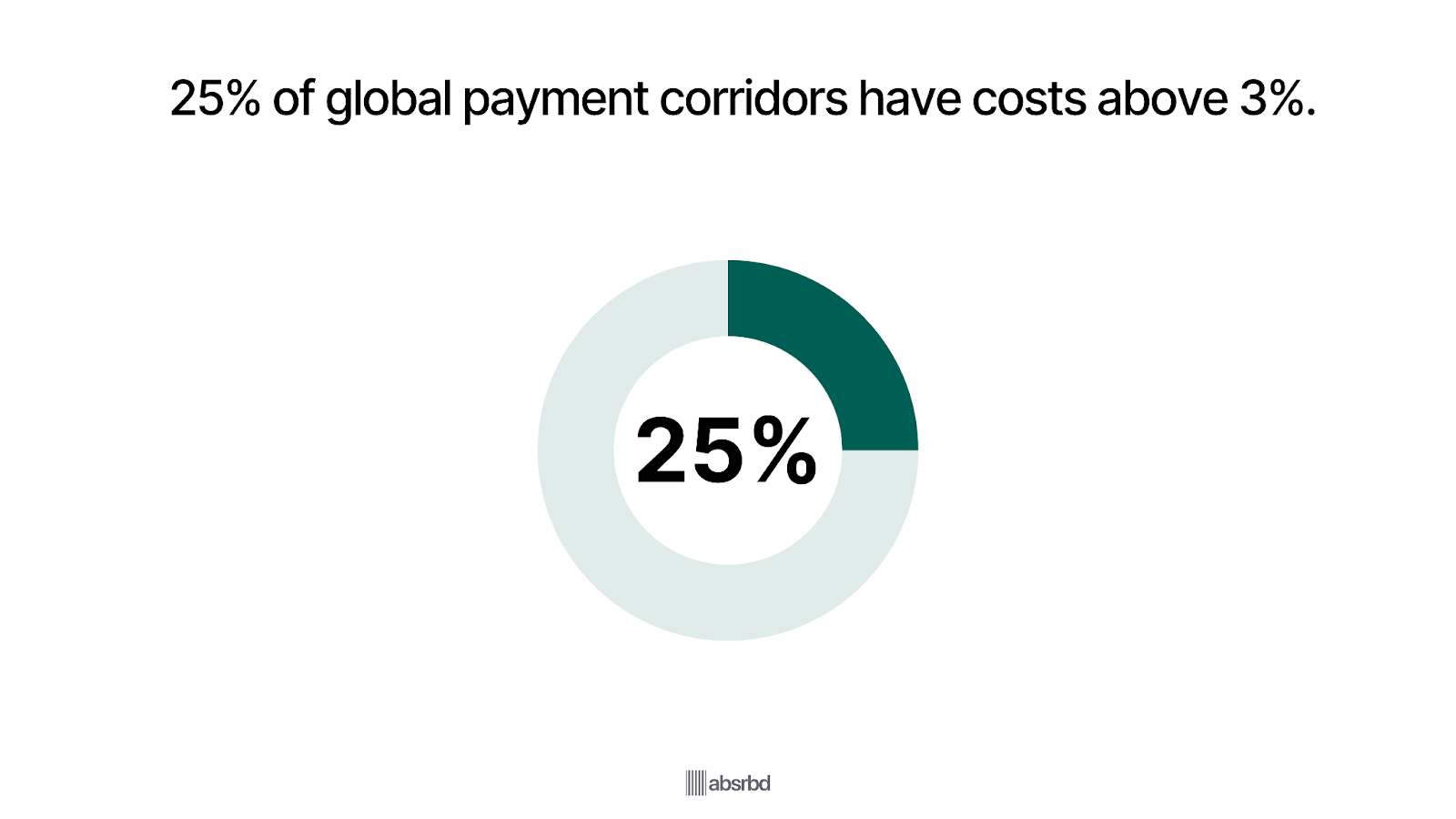

- For nearly one-quarter 25% of global cross-border payment corridors, costs exceed 3%. European Central Bank

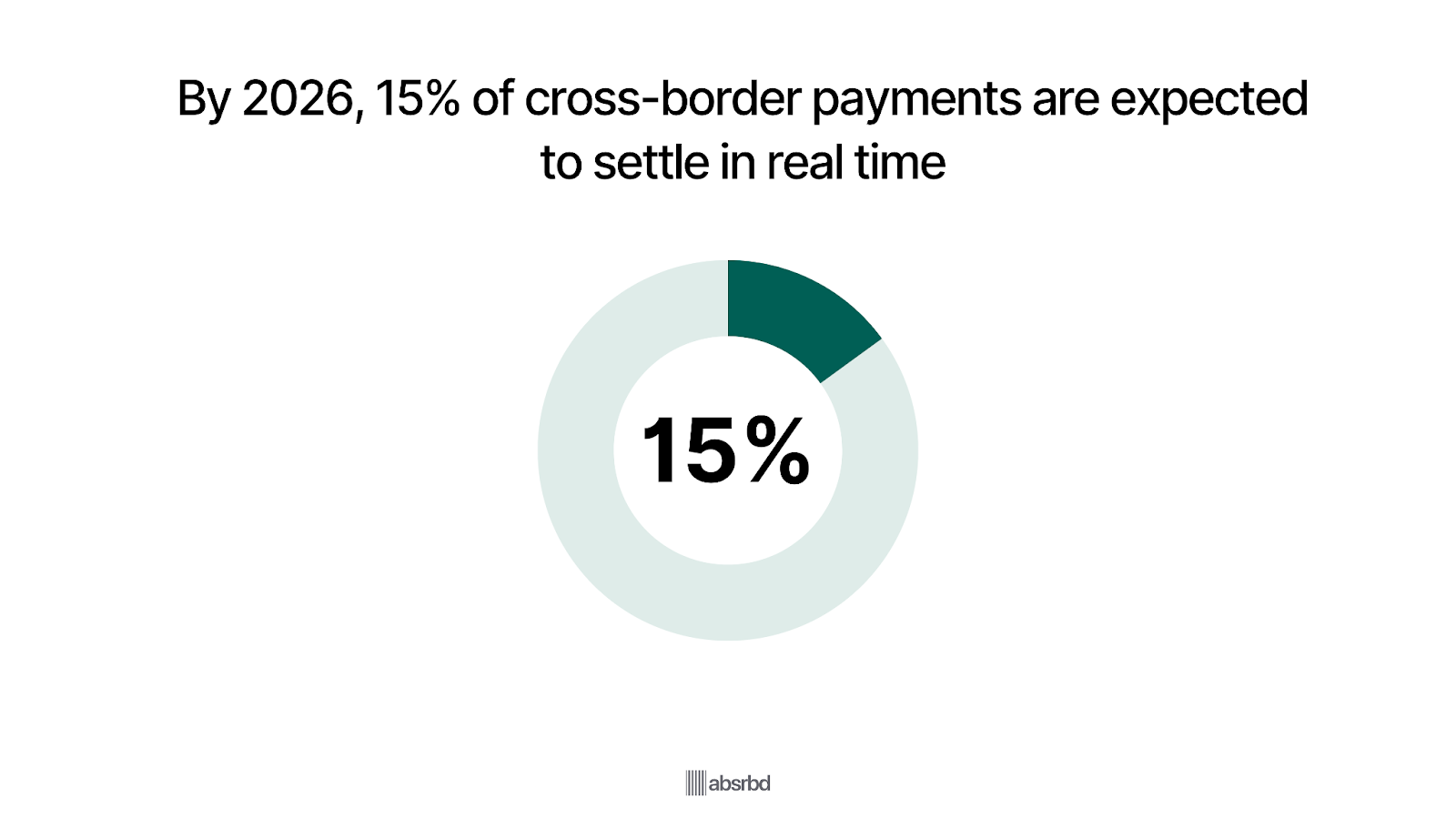

- By 2026, 15% of cross-border payments are expected to settle in real time according to an IDC prediction. IDC

- The U.S. is a major source of remittances, and it is estimated that $100 billion is sent annually to countries like Mexico and Central America. IMF

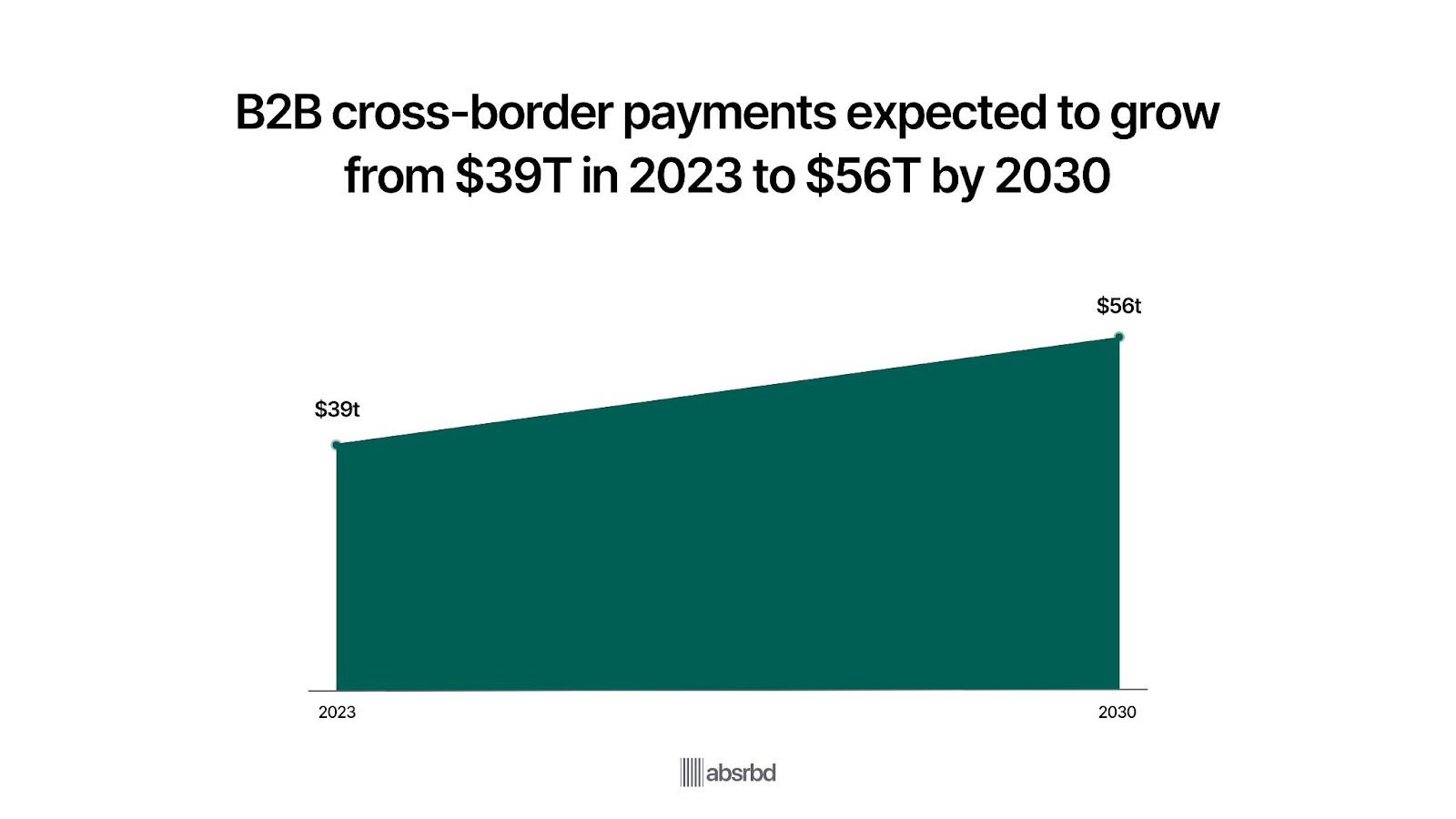

- The B2B segment is expected to grow from $39 trillion in 2023 to $56 trillion by 2030. Convera

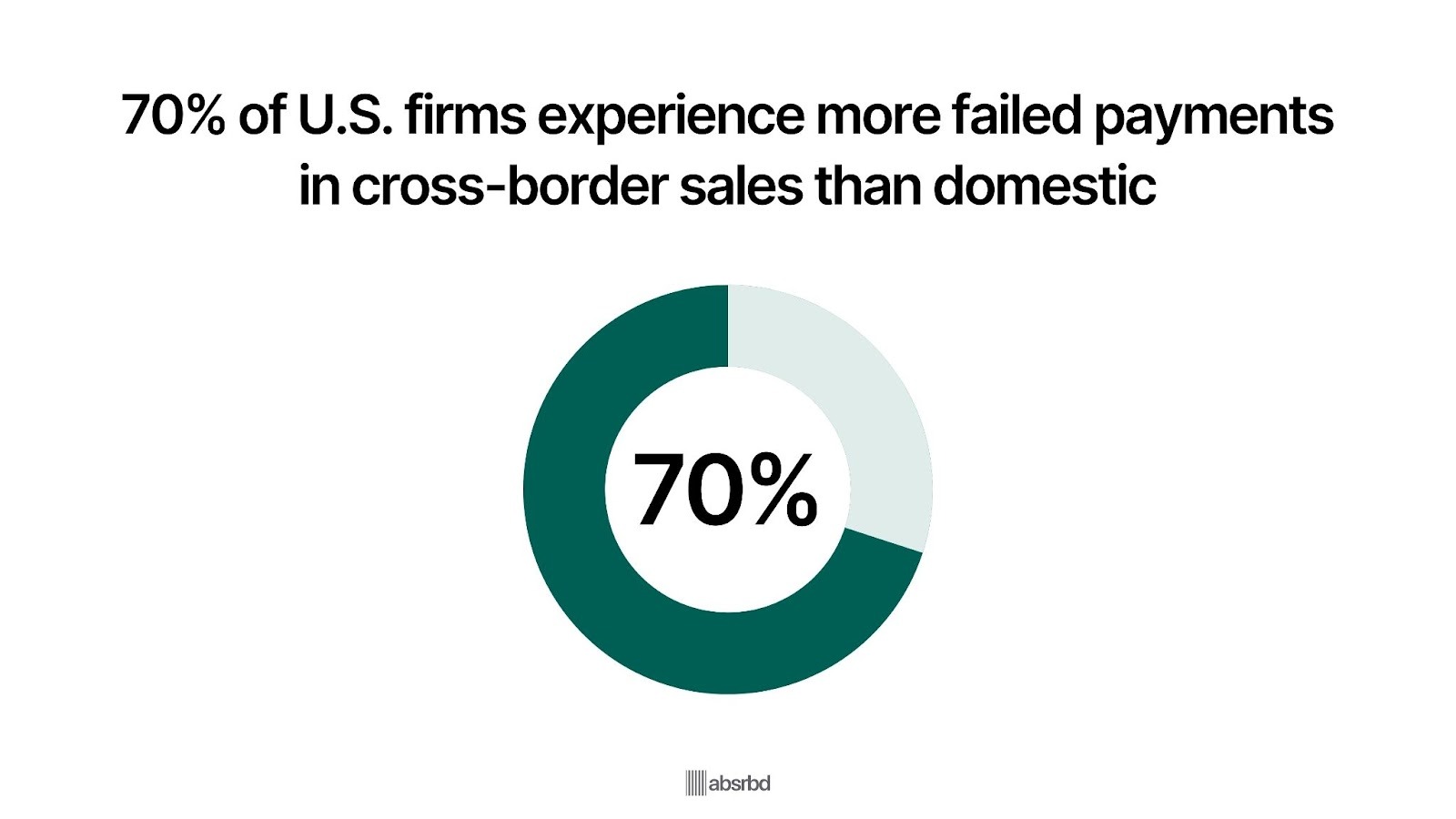

- 70% of U.S. firms experienced higher rates of failed payments in cross-border than domestic sales. PYMNTS

- Faulty cross-border payments cost U.S. merchants at least $3.8 billion in sales last year alone. PYMNTS

Major Trends Shaping Cross-Border Payments

Cross-border payments are changing rapidly, driven by technological innovation, regulatory shifts, and changing customer expectations that are reshaping global financial flows.

92% of Businesses Expect Payment Improvement

Real-time payments are becoming a fundamental aspect of cross-border transactions, with 92% of businesses anticipating significant investments in this area over the next 24 to 36 months, according to a global survey. BNY Mellons

This trend is significant as it reflects the growing demand for faster, more efficient payment solutions that enhance customer experience and operational efficiency.

As businesses recognize the benefits of real-time payments, including improved cash flow and customer loyalty, they are increasingly adopting these capabilities to stay competitive in the global market.

77% of Customers Expect FIS to Leverage AI for Better Fraud Prevention

A survey found that 77% of customers expect FIs to leverage AI for better fraud prevention, underscoring the growing demand for advanced security measures. PYMNT

This trend is significant as AI can enhance the speed and accuracy of cross-border payments, providing businesses with valuable insights and reducing operational costs.

As AI technology continues to evolve, its application in cross-border payments is expected to drive innovation and improve overall service delivery in the industry.

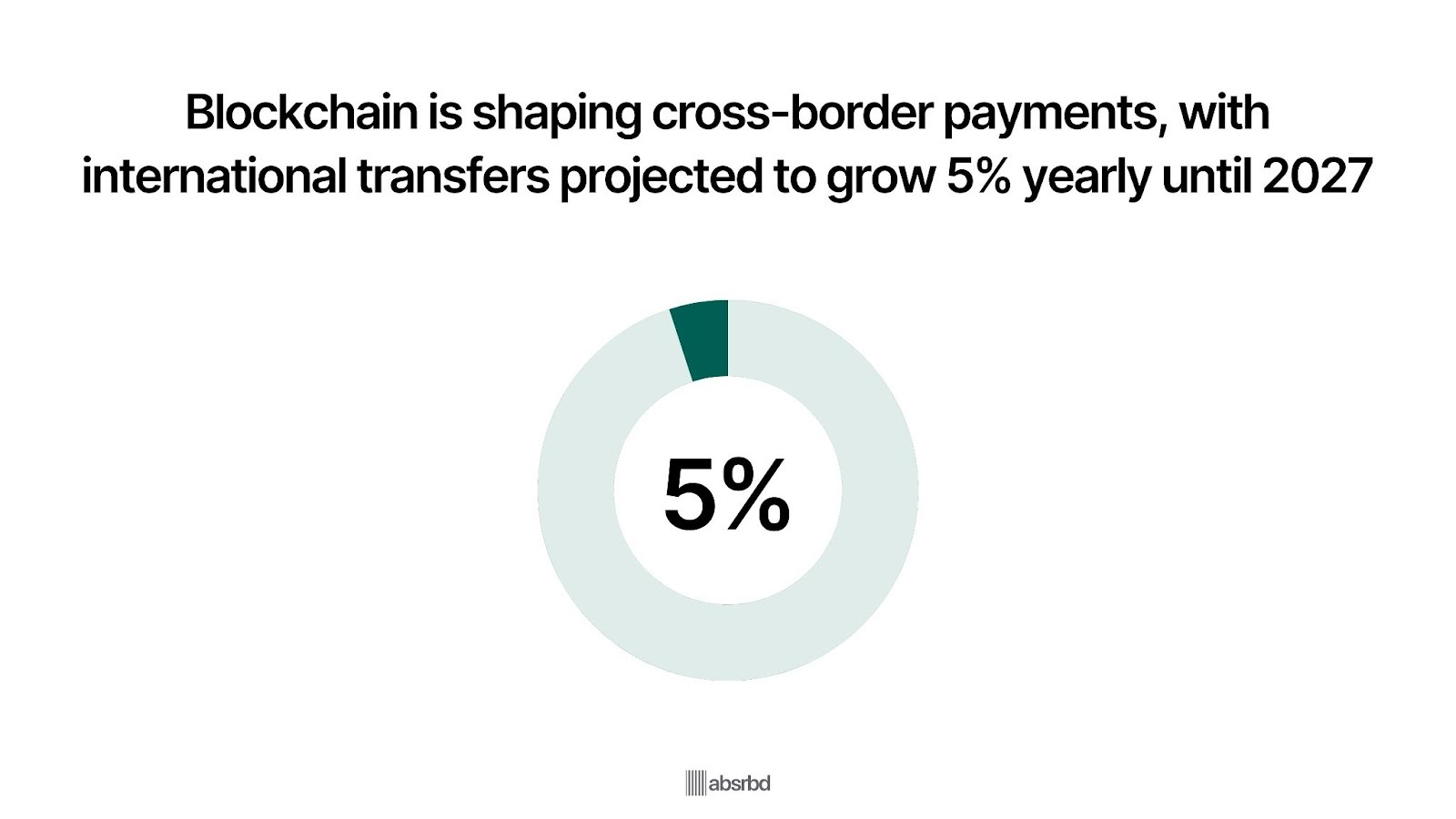

Cross-Border Payments Are Expected to Increase by 5% Each Year Through 2027

Cross-border payments are projected to grow by 5% annually until 2027, driven by consumer demand for faster and more efficient transaction methods. JP Morgan

As businesses and consumers increasingly operate globally, instant payment solutions have become paramount.

The rise of real-time payment systems is expected to generate an additional $173 billion in economic output by 2026, highlighting the significant impact of faster payment technologies on the global economy. ACI Worldwide

$5 Trillion in Stablecoin Transactions Power New Cross-Border Payment Rails

Stablecoins processed more than $5 trillion worth of transactions across blockchains in 2026, showing how crypto rails are evolving into viable global settlement systems. Cryptoslate

Remittance pilots using USDC in the UAE–India corridor aim to cut transfer costs by up to 100× compared with legacy SWIFT channels.

Transaction fees for stablecoin transfers now average under 1%, compared to the global remittance average of 3.5%, making blockchain one of the cheapest and fastest cross-border payment methods. McKinsey

This data shows that stablecoins are no longer fringe tools—they’re quietly becoming a competitive alternative to traditional banking infrastructure.

60 Central Banks at Different Stages of Research and Development of CBDCS

Central bank digital currencies CBDCs are gaining traction as a viable solution for cross-border payments, with over 60 central banks at different stages of research and development, according to PWC's CBDC Global Index.

These digital forms of fiat currency offer programmability, higher transparency, and the potential to transform the payment industry.

The integration of CBDCs is expected to provide a secure and efficient means for international transactions and foster collaboration between governments and financial institutions.

As central banks explore implementing digital currencies, the development of CBDCs could lead to a paradigm shift in how domestic and global economies operate.

Regulatory Changes and Compliance: There are about 19,000 tax jurisdictions worldwide

The emphasis on regulatory compliance is becoming increasingly critical in the cross-border payment industry, with over 19,000 tax jurisdictions worldwide, each with its own set of regulations that can change rapidly. PYMNTS

As businesses expand their operations internationally, they face the challenge of navigating a complex web of compliance requirements, which can significantly impact their ability to conduct cross-border transactions efficiently.

The transition from PSD2 to PSD3 regulations highlights the need for merchants to adapt to new compliance frameworks while ensuring secure payment processing.

This regulatory evolution is essential for maintaining consumer trust and protecting against fraud in the increasingly complex cross-border payment environment.

Key Challenges Facing the Cross-Border Payment Industry

The cross-border payment industry faces mounting challenges, from regulatory complexity and high transaction costs to security risks and technological fragmentation.

High Transaction Fees

High transaction fees are a significant challenge for businesses engaging in cross-border payments.

According to a survey, 68% of respondents are potentially paying unnecessary cross-border fees because they are processing payments where their business is headquartered rather than where their customer is located, and they have a legal entity. Blue Nap

These fees can quickly add up, including currency conversion, wire transfer, and commission fees from payment gateways, significantly impacting a business's bottom line.

Compliance and Regulatory Issues

Cross-border payments involve navigating a complex web of regulations and compliance requirements that vary across different countries and jurisdictions.

Payments can be declined due to the different policies and procedures of each bank or payment gateway.

Businesses must adhere strictly to these regulations, as in some countries, they cannot provide clients access to personal or commercial information.

Payment Processing Delays

International transactions can be time-consuming due to network frictions, and the process is often manual, leading to delayed payments.

The lack of standardization and regulation in cross-border payments compared to other types of transactions contributes to these delays.

Moreover, international transfers are less digitized than national transfers, with specific checks performed manually, causing unnecessary delays.

Currency Fluctuations and Exchange Rates

Currency exchange rates can be volatile, and fluctuations can have a significant impact on the value of cross-border payments.

This introduces uncertainty and risk for businesses and individuals engaged in international transactions.

Unfavorable exchange rates can lead to a major chunk of the payment amount being deducted from the fees associated with international transactions.

Liquidity Management

Cross-border payments often require liquidity management across multiple currencies and jurisdictions, which can be complex and resource-intensive.

Businesses and individuals may struggle to maintain sufficient liquidity to facilitate timely cross-border transactions.

Managing multiple bank accounts in different countries to facilitate currency payments can be time-consuming and costly.

Emerging Opportunities in Cross-Border Payments

Emerging opportunities in cross-border payments are being driven by real-time networks, digital currencies, and local currency settlement systems that are reshaping how money moves globally.

Adoption of Blockchain Technology: 5% Annual Growth in International Transfers. JP Morgan

Blockchain technology is emerging as a transformative force in cross-border payments, with international transfers expected to grow by 5% annually until 2027.

This technology enhances transaction speed and reduces costs by minimizing the need for intermediaries. For instance, blockchain can facilitate direct peer-to-peer transactions, significantly speeding up the payment process.

J.P. Morgan highlights that advancements in blockchain are crucial for addressing the complexities of cross-border payments, as they offer a more efficient alternative to traditional banking systems.

Real-Time Payments: 92% of Businesses Expect Significant Investment

Real-time payments are transforming cross-border transactions, with 92% of businesses anticipating major investments in this area over the next 24 to 36 months. BNY Mellons

This shift is significant as it meets the growing demand for faster, more efficient payment solutions that enhance customer experience and operational efficiency.

For example, SWIFT’s Global Payment Innovation GPI allows businesses to track payments in real-time, similar to package tracking systems, which improves transparency and reduces fraud risks.

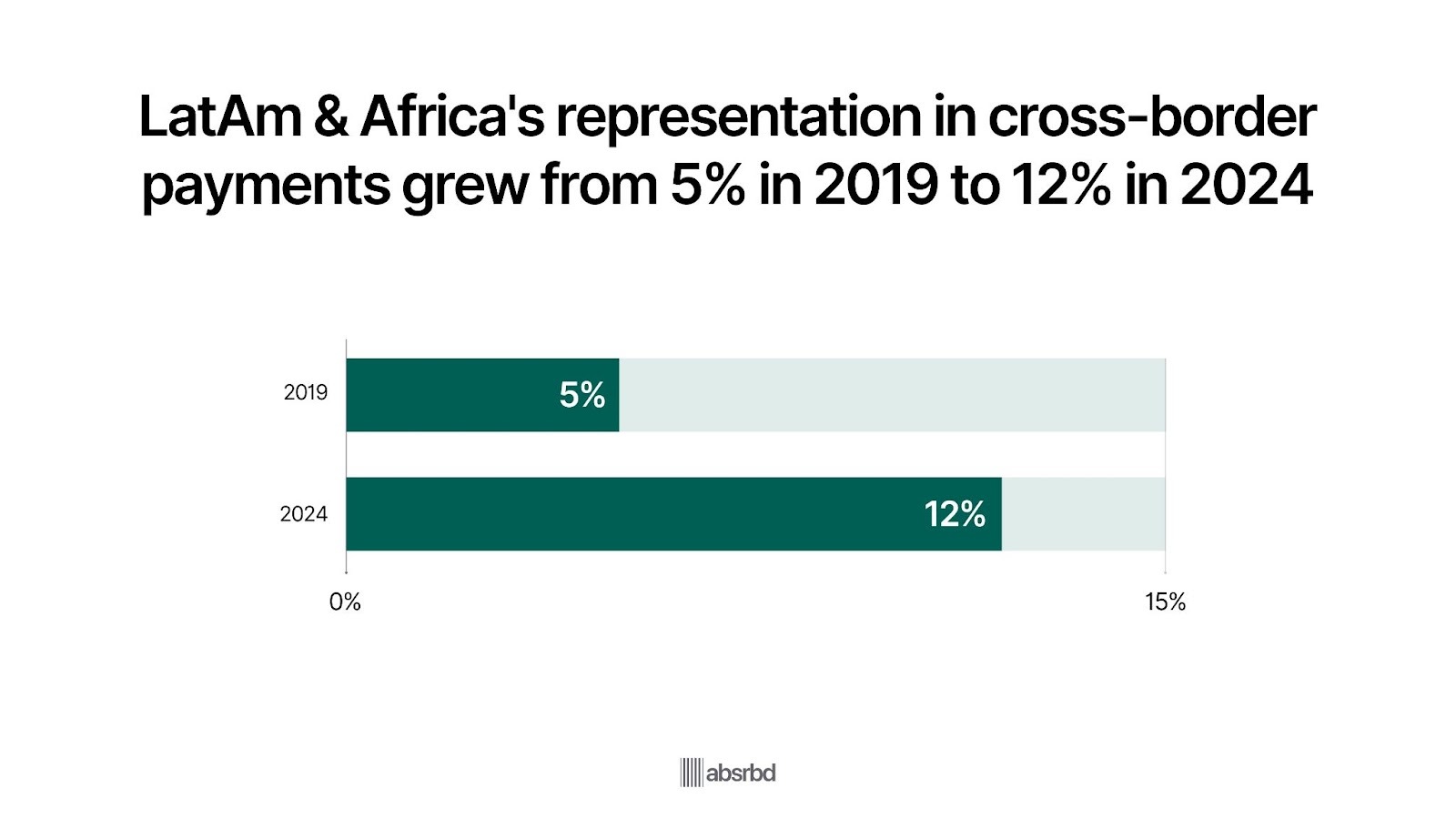

Expansion into Emerging Markets: 12% Increase in Representation Forbes

Emerging markets, particularly Latin America and Africa, present substantial growth opportunities for cross-border payment providers.

The representation of companies from these regions in the cross-border payment sector has increased from 5% in 2019 to 12% in 2024. Forbes

This growth is driven by the demand for local payment solutions tailored to specific market needs, such as India's UPI and Brazil's Pix, which cater to previously cash-dominated economies.

Companies like dLocal and Payoneer are capitalizing on this trend by establishing robust infrastructure in these markets, leading to significant revenue growth.

Increased Demand for Local Payment Methods: Cash Transactions Still Significant

As businesses expand globally, there is a growing need to accommodate local payment preferences.

In emerging markets, cash transactions remain prevalent, with companies like dLocal reporting that up to two-thirds of their transactions occur in cash.

This presents an opportunity for payment providers to develop localized solutions that cater to specific consumer behaviors and preferences. Businesses can enhance customer satisfaction and conversion rates by integrating popular local payment methods.

CBDCs and Digital Money to Transform Remittance-Heavy Corridors

Central Bank Digital Currencies CBDCs are increasingly seen as tools to reduce costs, speed up cross-border remittances, and bring transparency in corridors where remittance fees are high.

Lowering fees and intermediaries could significantly increase volume: high-cost corridors stand to gain most, both in terms of use and social impact.

Governments in emerging markets, especially where remittances form a large part of the economy, will likely be early adopters.

Enhanced Security Measures: Investment in Fraud Detection Technologies

With the rise in digital transactions, the threat of fraud has escalated, prompting businesses to invest in advanced security measures. Implementing machine learning and real-time transaction analysis allows for more effective fraud detection and risk management.

For example, intelligent acceptance tools can analyze transaction data to improve authorization rates and reduce fraud-related declines. This focus on security protects businesses and builds consumer trust, essential for fostering long-term relationships in cross-border transactions.

How the Major Trends Affect Different Groups

Consumers: Enhanced Convenience and Speed

The rise of real-time payments significantly benefits consumers by providing instant access to funds, which enhances their overall payment experience. A survey indicated that 75% of consumers prefer all digital payments to be processed in real-time. Integrated Research

This trend is particularly beneficial for individuals who rely on timely payments for essential services, such as utilities or emergency expenses. For example, platforms like Zelle allow users to send money instantly, making it easier for consumers to manage their finances and meet their obligations without delay.

Businesses: Improved Cash Flow and Operational Efficiency

Businesses are increasingly adopting real-time payment solutions to optimize cash flow management and streamline operations. According to ACI Worldwide, real-time payment transactions are projected to surge by 63% annually, reaching $511 billion by 2027. Stripe

This shift enables businesses to receive payments immediately, allowing them to reinvest funds without waiting for traditional transaction processing times. For instance, a utility company can receive payments instantly, reducing administrative burdens and improving cash flow management, which is crucial for maintaining operational efficiency.

Investors: Opportunities for Growth in Fintech

Investors are presented with new opportunities as the demand for innovative payment solutions continues to rise. With 92% of businesses planning to invest in payment improvements over the next 24 to 36 months, fintech companies that provide real-time payment solutions are likely to see substantial growth. BNY Mellons

For example, companies like Stripe and Square are capitalizing on this trend by enhancing their platforms to support instant transactions, attract investment and drive market expansion.

Financial Institutions: Need for Technological Adaptation

Financial institutions face the challenge of adapting to the growing demand for real-time payments. About half of businesses globally are considering changing their financial service providers to access real-time payment capabilities.

This shift compels banks and payment processors to invest in modernizing their infrastructure to remain competitive. Institutions that successfully implement real-time payment systems can enhance customer loyalty and attract new clients, as seen with the rapid adoption of services like FedNow in the U.S., which aims to facilitate instant transactions across banks.

Regulatory Bodies: Balancing Innovation and Security

Regulatory bodies must navigate the balance between fostering innovation in cross-border payments and ensuring consumer protection and security. As real-time payments become more mainstream, concerns about fraud and compliance will escalate.

For instance, while 99.9% of transactions on platforms like Zelle are reported as secure, the potential for scams remains a concern. Fiserv

Regulatory frameworks will need to evolve to address these challenges while supporting the growth of innovative payment solutions.

Conclusion

The trends in cross-border payments have far-reaching implications for various stakeholders. For consumers, the rise of real-time payments and digital wallets means enhanced convenience and speed, with 75% preferring all digital payments to be processed instantly.

Meanwhile, businesses must contend with the need to adapt to new technologies and meet heightened expectations, as 92% plan to invest in payment improvements over the next 24 to 36 months.

These shifts are driving a reevaluation of the role of financial institutions.

As the demand for real-time payments surges, about half of businesses are considering changing their financial service providers to access these capabilities.

As a result, we're likely to see banks and payment processors invest heavily in modernizing their infrastructure to remain competitive.

Moving forward, success in this space will hinge on the ability to balance innovation and security. Regulatory bodies must evolve frameworks to address concerns like fraud while supporting the growth of innovative payment solutions.

Those who prioritize customer experience, leveraging new technologies while ensuring compliance, will be best positioned to thrive in the evolving industry of cross-border payments.

Cross Border Payment Frequently Asked Questions

How Big is the Cross-Border Payment Industry?

- The global cross-border payments market was valued at USD 190.2 billion in 2023. The Brainy Insight

- The market is projected to grow to $392.01 billion in 2033 at a CAGR of 7.5%. The Brainy Insight

- The wholesale market, which includes high-value transactions, accounted for around $146 trillion in 2023, while the retail market totaled approximately $44 trillion in 2023. Convera

Why Do Cross-Border Payments Fail?

Cross-border payments can fail for several reasons, impacting businesses and consumers alike.

Here are some key factors contributing to the failure of these transactions:

High Transaction Fees: A significant challenge for businesses engaging in cross-border payments is the high transaction fees involved. Approximately 68% of business owners report paying unnecessarily high transaction fees, which can deter them from completing transactions or lead to payment failures due to insufficient funds after fees are deducted.

Compliance and Regulatory Issues: Cross-border payments must navigate a complex web of regulations that vary by country. Payments can be declined due to differing policies and procedures among banks and payment gateways. This regulatory complexity can lead to failed transactions if businesses do not adhere strictly to compliance requirements.

Payment Processing Delays: International transactions can be time-consuming due to network frictions and manual processing. The lack of standardization in cross-border payments compared to domestic transactions contributes to these delays, which can result in rejection or failure to be processed in a timely manner.

Currency Fluctuations and Exchange Rates: The volatility of currency exchange rates can significantly impact the value of cross-border payments. Unfavorable exchange rates can lead to a major portion of the payment amount being deducted from fees, causing transactions to fail if the final amount does not meet the intended recipient's requirements.

Liquidity Management Issues: Managing liquidity across multiple currencies and jurisdictions can be complex and resource-intensive. Businesses may struggle to maintain sufficient liquidity to facilitate timely cross-border transactions, leading to potential failures if funds are not available when needed.

Technical Failures: Technical issues such as system outages, software bugs, or connectivity problems can also lead to payment failures. These technical challenges can disrupt the processing of transactions, causing delays or complete failures.

Fraud and Security Concerns: The increasing threat of fraud in cross-border payments can result in transaction failures. Financial institutions often implement strict security measures that may flag legitimate transactions or decline them if they appear suspicious.

What is the Average Cost of Cross-Border Payment?

The average cost of cross-border payments can vary significantly depending on several factors, including the countries involved, the type of transaction (e.g., bank transfer, remittance, the amount being sent, and the service provider used.

The global average cost for sending remittances is typically around 6-7% of the transaction amount. This figure comes from regular reports by organizations like the World Bank, which tracks remittance costs globally.

For larger business-to-business transactions, the costs can be lower in percentage terms but may involve higher flat fees. These costs often include exchange rate margins and various bank charges.

It's worth noting that international organizations and many countries have been pushing to reduce the cost of cross-border payments. The United Nations Sustainable Development Goals, for instance, include a target to reduce the average cost of remittances to less than 3% by 2030.Many fintech companies and digital payment platforms are working to significantly lower these costs, sometimes offering rates below 1% for certain corridors.

Who Pays the Cross-Border Fee?

The cross-border fee is typically paid by the sender of the funds, though in some cases it may be shared or passed on to the recipient. Here's a brief overview:

- Consumer remittances: Usually, the sender pays the fee upfront when initiating the transfer.

- Business transactions: Often, the sending business pays the fee, but some may arrange for the recipient to cover it or split the cost.

- Wire transfers: The sender generally pays, but some banks also charge recipients a fee for incoming international transfers.

- Credit card purchases: When making international purchases, the cardholder (buyer) typically pays any foreign transaction fees.

- Online platforms: Some services offer options where either the sender or recipient can choose to pay the fee.

The specific arrangement can vary depending on the financial institutions involved, the countries, and the agreement between parties. Some businesses may absorb these costs to attract customers or include them in their pricing.